Masayoshi Son created SoftBank from a Computer software package distributor into a world conglomerate.

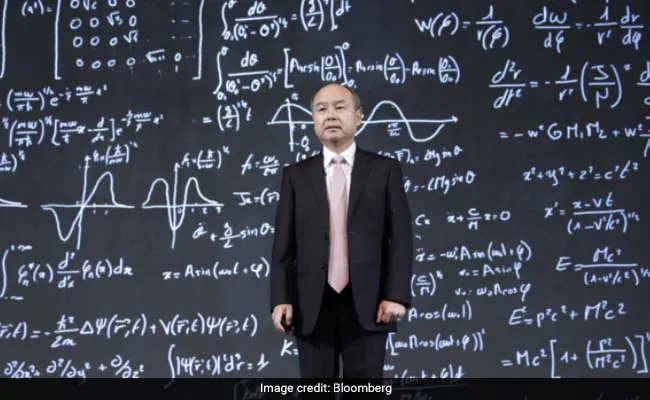

Masayoshi Son’s final earnings briefing was between his most somber in recent memory. The generally irrepressible billionaire opened by evaluating the devastating effects of the coronavirus outbreak to the Great Depression. Son went on to describe why his SoftBank Group Corp. experienced just posted the most significant losses in its 39-yr historical past. The company’s $100 billion Vision Fund missing practically $18 billion creating down the price of portfolio businesses, which include WeWork and Uber Technologies Inc. Then came this slide.

Son may have been hoping to make a place that even though some of his investments are possible to are unsuccessful, many others will emerge much better from the disaster. But the graphic drew ridicule in the push and on social media. It did not aid that a few several hours later he lamented about getting misunderstood, like Jesus Christ.

His proclamations may be easy to snicker at, but they belie a serious shortcoming: Son is getting a really hard time communicating his concept. When SoftBank was mostly a domestic participant, audiences in Japan ended up made use of to his eccentric type – from declarations about curing human disappointment to SoftBank’s Pepper robot examining out fiscal final results. But in recent decades, world-wide buyers have tuned in – only to be baffled or even worse by Son’s presentations.

“That kind of quirkiness used to add to Son’s charisma. But the legendary investor halo he once had above him has slipped and now these points are doing work versus him,” claimed Justin Tang, head of Asian analysis at United To start with Associates in Singapore.

The inner circle at Tokyo headquarters was taken aback by the harsh reception final thirty day period, but people acquainted with Son’s strategy say it really is not going to adjust any time quickly. They claim it demonstrates the billionaire’s individual flavor, with an goal to give clear themes in shows, applying simple representations he thinks any individual can realize. Son likes to use metaphors to make hard concepts more accessible, with at the very least one slide that he reckons captures the wide information. In February, that intended a slide with the words “Tide is turning” and an impression of the ocean. In May perhaps, it was the Fantastic Depression analogy. This week, he’ll provide his up coming big topic at SoftBank’s once-a-year shareholders meeting.

Son created SoftBank from a Computer program distributor into a global conglomerate by using on debt to pay for daring acquisitions.

Son, 62, is intently involved in producing the slides. He has a crew of about a half a dozen up-and-coming SoftBank employees in their late 20s and early 30s liable for drafting the displays, in accordance to former staffers. They accumulate his pronouncements in the course of the year to use as fodder for drafts that Son meticulously vets, at times making past-minute improvements that send out the staff scrambling.

In fact, the Valley of the Coronavirus was no aberration. Son has been defying PowerPoint conventions for a long time. What follows is a quick overview of his unconventional endeavours.

Son created SoftBank from a Personal computer software program distributor into a world-wide conglomerate by using on debt to spend for daring acquisitions. He has constantly struggled to persuade traders to credit rating SoftBank for its investments in technologies startups, with its stock chronically buying and selling at a low cost to the benefit of its shareholdings. Over the yrs, Son has tried using numerous visible metaphors to persuade buyers his firm is undervalued. In November 2014, he made use of Aesop’s fable of the goose that laid the golden eggs.

“SoftBank is a goose with a lot more golden eggs in its belly, even if it truly is far too early to provide them to the market,” Son spelled out to reporters and analysts at the briefing. “SoftBank is at present valued fewer than the sum of its golden eggs.”

4 decades later on, the “goose quality” failed to materialize and Son took a distinct method, relying on the raw ability of mathematics.

The method is the 25 trillion yen ($234 billion) worth of SoftBank’s property at the time minus 4 trillion yen in credit card debt, significantly from getting equivalent to its current market capitalization of 9 trillion yen. The stock was investing at a 50 % low cost to the firm’s individual sum-of-the-elements calculation that contains the domestic telecoms device, Alibaba Team Keeping Ltd., U.S. carrier Sprint Corp. and Yahoo Japan Corp.

Past November, SoftBank noted its 1st quarterly running loss in 14 many years just after having a $4.6 billion demand for WeWork, whose impressive implosion led to a $9.5 billion rescue offer from the Japanese enterprise. Son took to the phase to defend the expense and sketch out a really “hypothetical” path to profitability.

In February this calendar year, one quarter just after the meltdown at WeWork brought on a document reduction for the Japanese company, Son arrived up with yet another riddle – 1 intended to drive dwelling how an object can glimpse pretty different depending on point of view.

He urged investors to focus on SoftBank’s shareholder worth, which would consist of its stake in Alibaba, somewhat than running gain, which is swayed by share price fluctuation in investments like Uber. “The only measure by which SoftBank, an financial commitment business, must be evaluated by is irrespective of whether shareholder price rises or falls,” he reported.

Son often starts off his shows by asking the query: What is SoftBank? Even though the reply has ongoing to evolve in excess of the several years, some things stay continual: a perception of a grand social mission and his obsession with remaining No. 1.

The billionaire portrays himself as a true believer in the information and facts revolution, a proponent of the so-identified as singularity-the idea that a single working day computer systems will mesh with human brains and bodies. Son calls on these ideas every time he desires to give context to his most current adventure.

Son thinks no field is safe and sound from seismic, technological adjust and only the strongest will endure. That is why he has sought to existing SoftBank as dominant from the time when it was anything but.

But Son reserves his weirdest and most sentimental ideas for SoftBank’s annual shareholder conferences.

Most of Son’s predictions about the potential of technological know-how are nevertheless lots of a long time forward, but some have currently appear genuine. SoftBank’s working earnings did attain the 1 trillion yen mark in fiscal 2013. Last yr, it marked a different report – a 1.35 trillion yen loss.

Pop culture practitioner. Bacon expert. Explorer. Tv maven. Wannabe student. Subtly charming social media nerd.